Document Tag: Benefit Trends

-

Video – Empowering the Next Generation: Making Benefits “Easy” for Young Employees

Video Don’t let benefits uncertainty cost your employees money and peace of mind. Many younger workers feel overwhelmed during open enrollment, leading to missed opportunities for care. We’re committed to changing that. We’ve developed 5 easy-to-implement strategies to help your Gen Z and Millennial employees navigate their options with confidence. *Maximize your message with our…

-

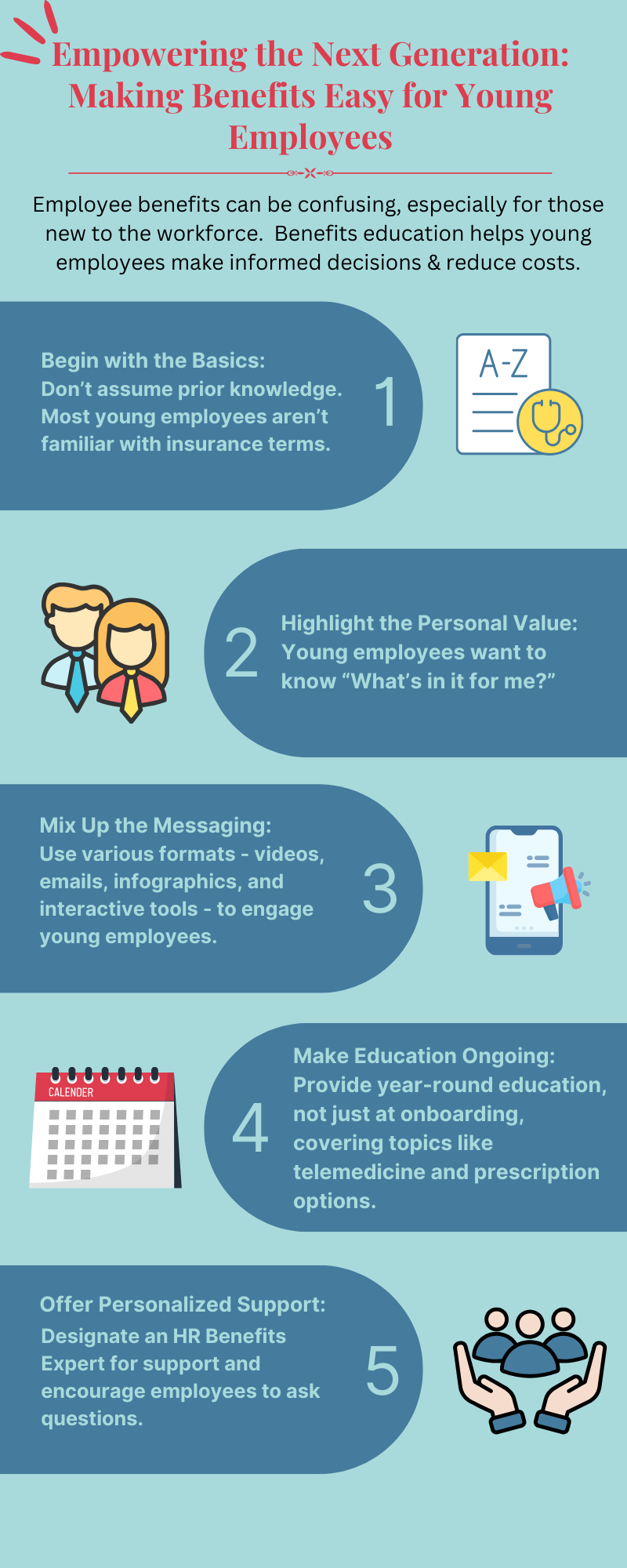

Infographic – Empowering the Next Generation: Making Benefits “Easy” for Young Employees

Infographic Employee benefits can be confusing, especially for those new to the workforce. In fact, only 7% understand the basic health insurance terms, costing businesses billions each year. Read our latest infographic for 5 simple, effective strategies to help them navigate their options and avoid costly mistakes. ** Infographics are powerful visual tools that transform…

-

Article – Empowering the Next Generation: Making Benefits “Easy” for Young Employees

Article Health insurance isn’t getting any easier for young professionals. Soaring costs are squeezing budgets, and over half of Gen Z and Millennials admit they don’t really understand their health plan options—leading many to just pick a plan at random. Nearly half say they’re unsure where to get help when it’s time for open enrollment.…

-

Social Media Kit – Empowering the Next Generation: Making Benefits “Easy” for Young Employees

Article Health insurance isn’t getting any easier for young professionals. Soaring costs are squeezing budgets, and over half of Gen Z and Millennials admit they don’t really understand their health plan options—leading many to just pick a plan at random. Nearly half say they’re unsure where to get help when it’s time for open enrollment.…

-

Presentation – 3 Surprising Benefits to a Virtual Open Enrollment

Presentation: 3 Surprising Benefits to a Virtual Open Enrollment THE CHALLENGE? THE OPPORTUNITY. With many multi location clients requiring virtual enrollments, you may feel at a disadvantage. but there are many reasons to believe a virtual open enrollment strategy could be even more effective for you and your clients.

-

Social Media Kit – Benefits 101: Embedded vs. Non-Embedded Deductibles

Article Understanding the two main types of deductibles for family coverage is crucial in preparing for out-of-pocket health care costs. Read our latest blog post to discover the differences between Embedded and Non-Embedded Deductibles. Video For family health insurance coverage, understanding the differences between embedded and aggregate deductibles will help you plan for out-of-pocket health…

-

Social Media Kit – 8 Unique Employee Perks That Don’t Require a Big Budget

Article: Understanding the latest benefits trends can help employers evaluate their offerings to best meet employee needs, respond successfully to their challenges and give them an advantage over their competitors. Proactively reacting to these trends keeps employees happy, healthy and loyal. Video: Benefits packages are one of the key factors that can influence an employee’s…

-

Article – Navigating Your Health Plan: A Guide to Your EOB

Custom Article An Explanation of Benefits (EOB) is generated when your provider submits a claim for the services you received. The insurance company sends you EOBs to help make clear the cost of the care you received. Read our latest article to learn how EOBs work and why they are a valuable resource. Download a…

-

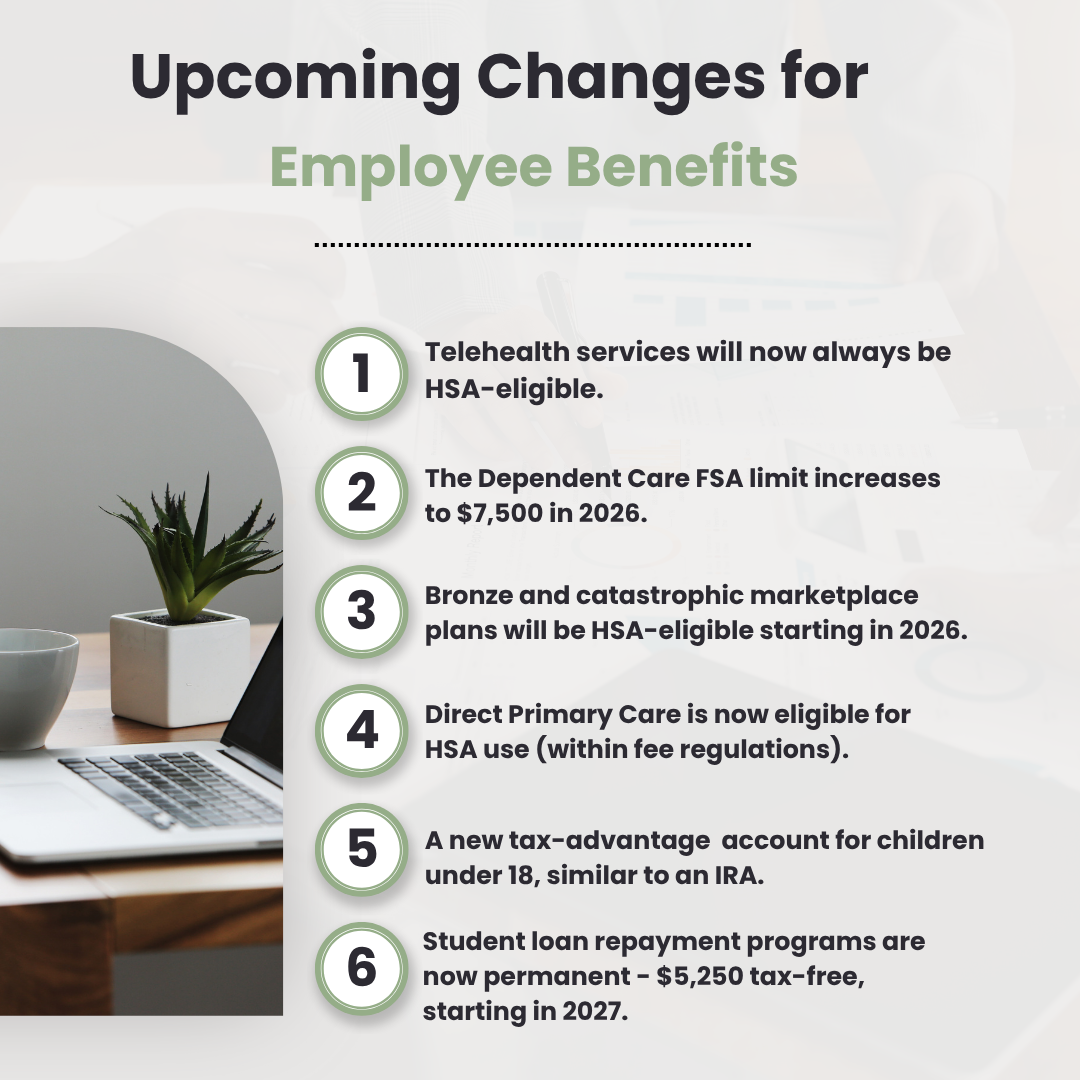

Infographic – The Latest in Employee Benefits: Comprehensive Changes for Employers and Employees

Infographic It’s time to prepare: The recently enacted “One Big Beautiful Bill” Act introduces sweeping changes that will reshape employee benefits, tax, and compliance for employers and benefits advisors. ** Infographics are powerful visual tools that transform complex information or data into easy-to-understand, engaging graphics.

-

Article – The Latest in Employee Benefits: Comprehensive Changes for Employers and Employees

Custom Article Major benefit updates are on the way—here’s what’s changing: ✅ Telehealth services are now permanently HSA-compatible. ✅ Direct Primary Care is now eligible for HSA use (within fee regulations). ✅ Bronze and catastrophic marketplace plans will be HSA-eligible beginning in 2026. ✅ The Dependent Care FSA limit increases to $7,500 in 2026. ✅…